It’s never too early to start thinking about your legacy and what you want to be remembered for. What kind of impact do you want to have on the world? These are tough questions to answer, but they’re worth thinking about.

Key Takeaways

What Is Legacy Planning?

A legacy plan is a way to ensure that your assets and estate are distributed according to your wishes after you pass away. An estate plan is created to protect your loved ones and provide for them financially, as well as to minimize taxes on your estate. A financial advisor can help you create a plan that takes into account the size of your estate and your goals for charitable giving. But by bequeathing your assets through a legacy plan, you can have peace of mind knowing that your loved ones will be taken care of.

How To Plan Your Legacy Properly?

When it comes to starting the legacy planning process, the first step is to determine what assets you have and how you want to distribute them. This includes taking into account any taxes that may be owed on those assets as well as drafting a plan with the help of a financial advisor. Once you have a plan in place, you can begin investing in accounts that will help support your legacy after you’re gone. This may include estate planning and insurance policies. Keep in mind that everyone’s situation is unique, so what works for one person may not work for another.

There are a few key things you can do to start planning your legacy:

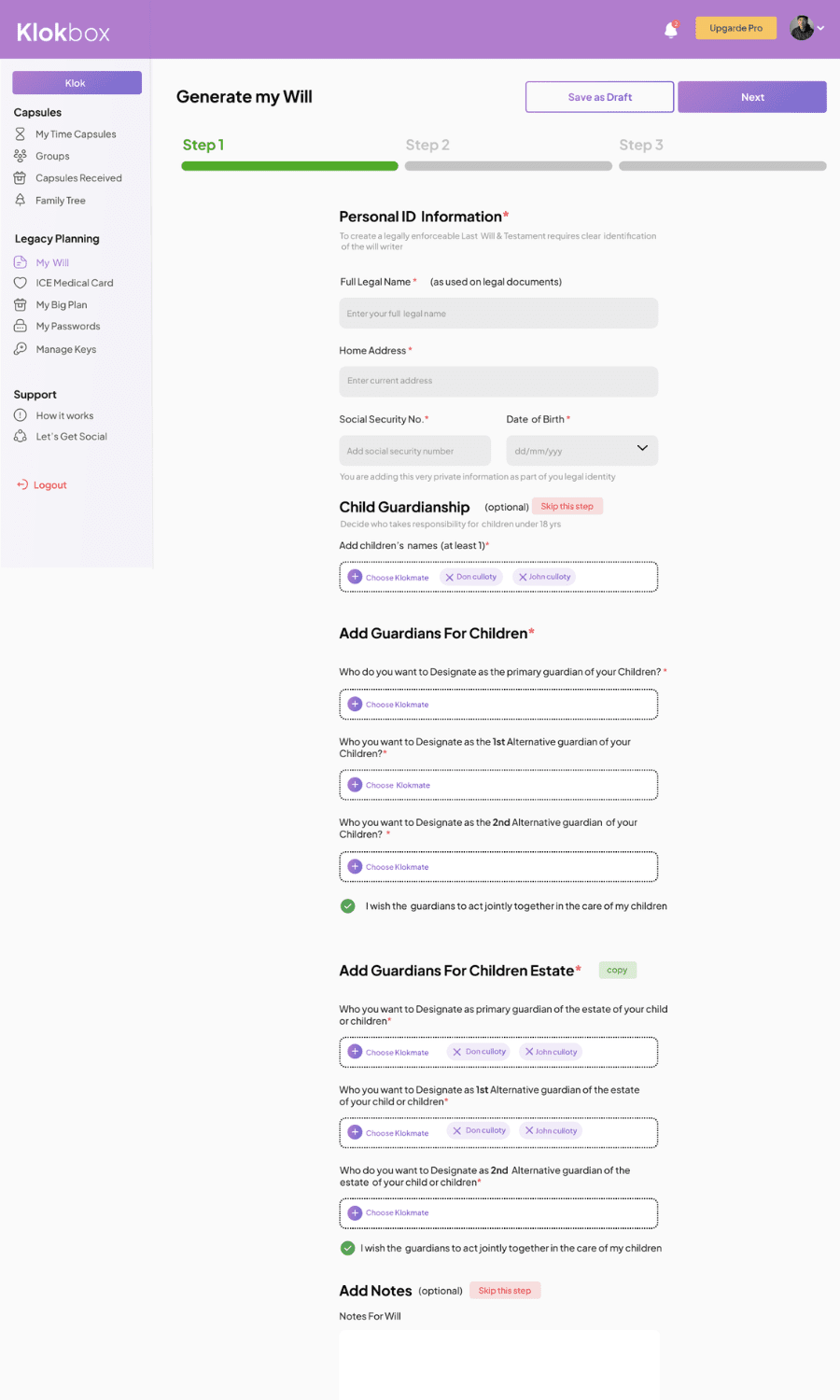

- Identify your values and assets

What’s important to you? What do you stand for? Once you know your values, you can start living them out every day. You can also start working on projects that align with your values and that you’re passionate about. - Who are your beneficiaries

It’s also important to think about who you want to pass your legacy to. Who will benefit from it the most? Who will carry on your work after you’re gone? Make sure to communicate your wishes to those people so they can help make your legacy a reality. - Witness & Sign

After you listed your assets, identified your beneficiaries, and added the residual cases, it’s time to witness and sign your legacy plan. Different countries and states have their particular laws when it comes to witnessing a legacy plan or the last will.

The easiest and fastest way to create a legacy plan is by using Klokbox. In 3 easy steps, you make sure your financial and emotional assets are secure and taken care of. Try it yourself here.

Legacy planning with Klokbox

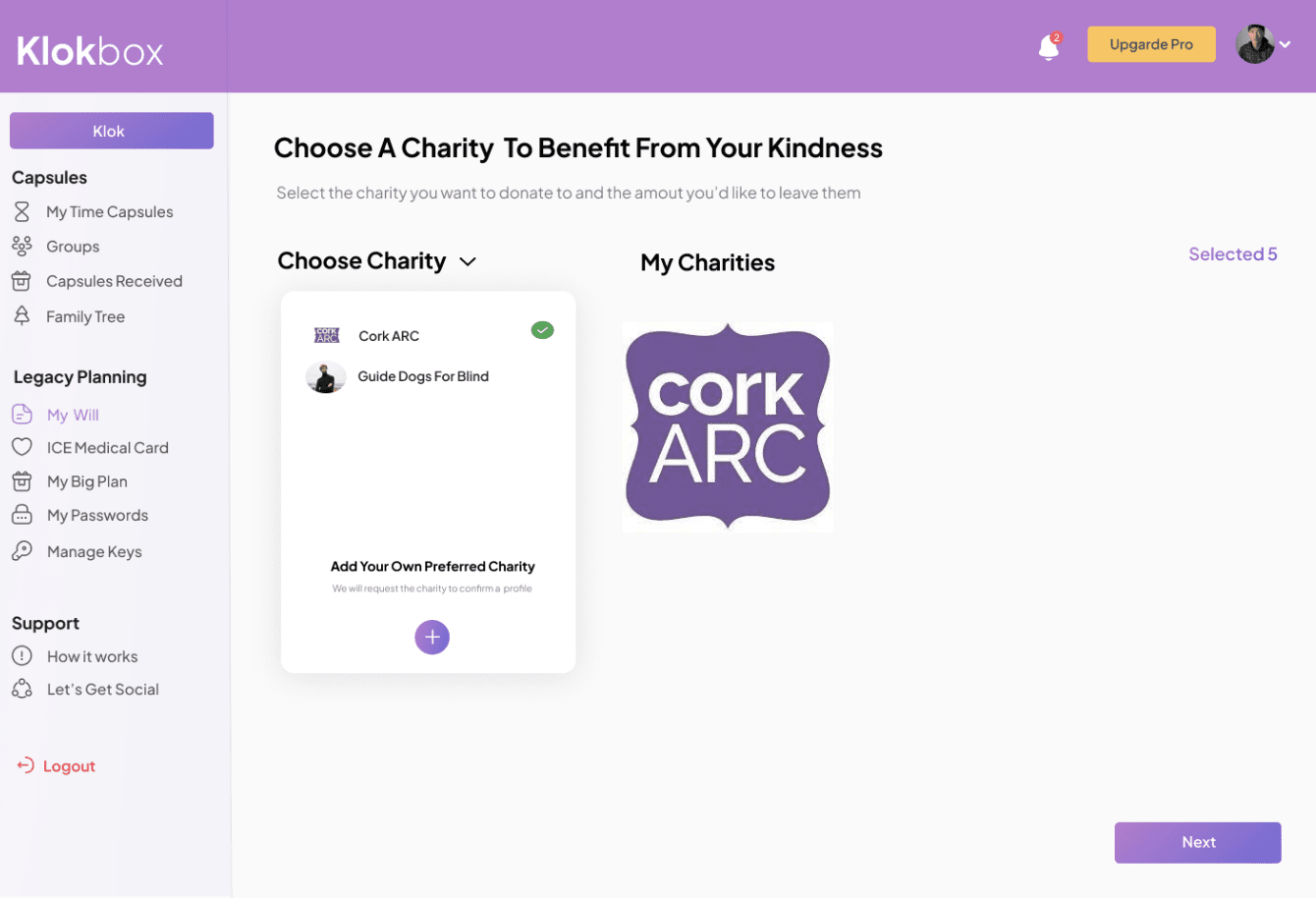

Do You Want to Leave a Charitable Legacy?

One of the best ways to reduce your tax liability is to donate assets to charity. If you want to leave a charitable legacy, you can do so by passing on your estate to a charity of your choice. This will allow your loved ones to receive a tax deduction for the value of the donated asset. You can also create a legacy plan that will allow you to donate assets to a charity of your choice upon your passing.

Legacy planning on Klokbox

What is the Difference Between Estate Planning and Legacy Planning?

Estate planning is the process of organizing and managing your property and affairs while you are alive, in anticipation of your death or incapacity. A legacy plan is a specific type of estate plan that focuses on what you want to leave behind after you die, and how you want to be remembered. An estate plan can include a legacy plan, but it is not required.

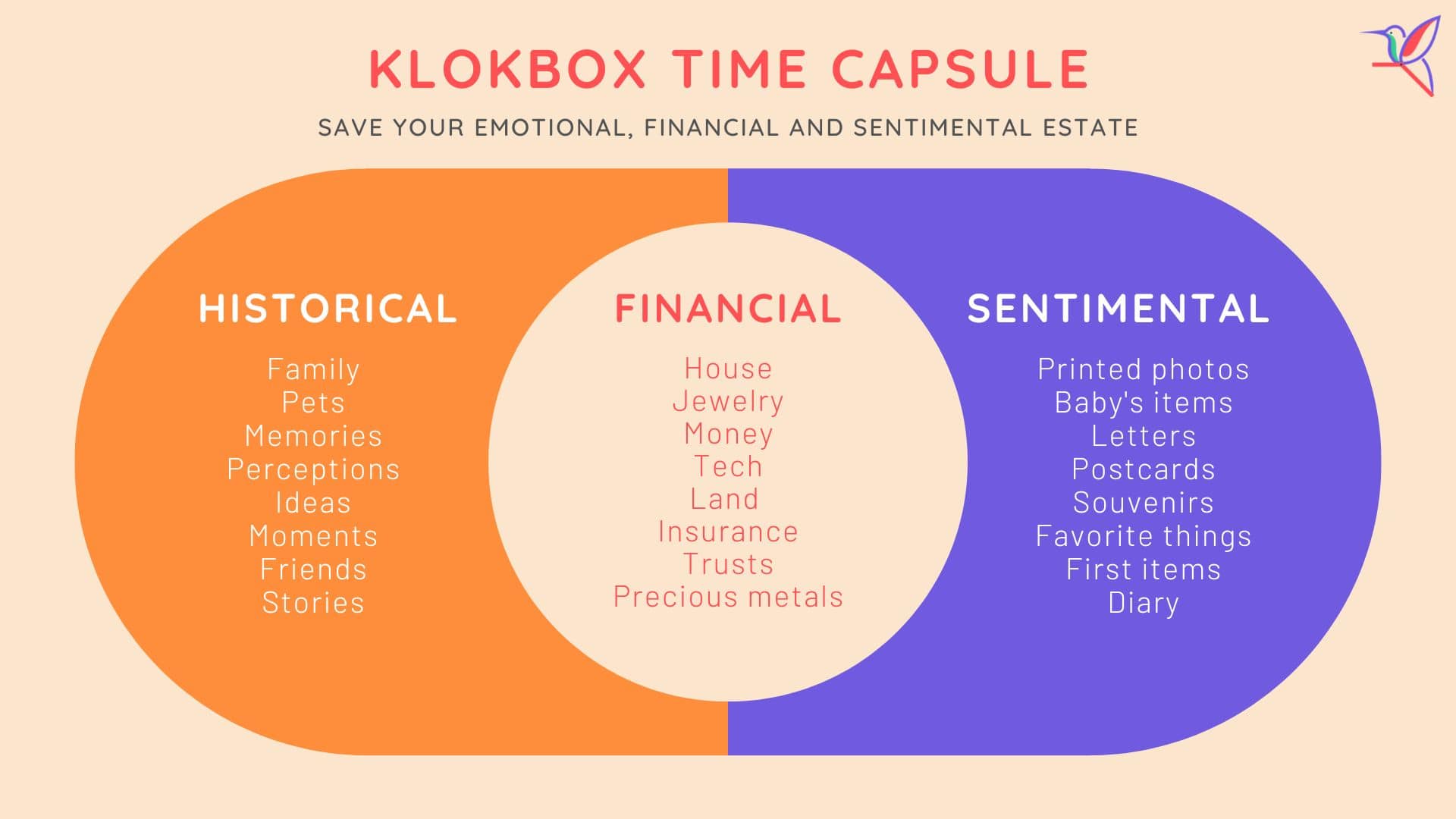

What About Your Emotional Legacy

It is said that we die twice, once when our physical body dies and once when our last memory fades. It is natural for us to pass on our wisdom, emotions, and wealth, something that will be lasting for generations. For many people, that legacy is their faith, their family, or their work. But for some, their legacy is their emotions.

What is an emotional legacy?

Emotional legacy is the positive emotions that we leave behind after we die. They are our memories, our love, our laughter, and our joy. Emotional legacy is the thing that we want to be remembered for.

Why plan your emotional legacy?

When we plan our emotional legacy, we are deliberately choosing what emotions we want to leave behind. We are choosing to be remembered for our positive emotions, rather than our negative ones.

No matter how you choose to plan your emotional legacy, the important thing is that you do it. By planning your emotional legacy, you can ensure that your memories and your love will live on long after you are gone.

Klokbox helps ensure your love and shows you care. Start kloking your memories, ideas, stories, videos, and audio recordings. Try it yourself here:

Why now it’s the right time?

Life is unpredictable and tomorrow isn’t guaranteed for any of us. By making sure your financial and emotional affairs are in order, you prepare for the inevitable and you make sure your family is taken care of.

Ready to take your next step?

It’s never too early to start thinking about your legacy. What kind of impact do you want to have on the world? These are tough questions to answer, but they’re worth thinking about. A legacy plan is a way to ensure that your assets and estate are distributed according to your wishes after you pass away.

An estate plan is created to protect your loved ones and provide for them financially, as well as to minimize taxes on your estate. A financial advisor can help you create a plan that takes into account the size of your estate and your goals for charitable giving.

By bequeathing your assets through a legacy plan, you can have peace of mind knowing that your loved ones will be taken care of, and by creating time capsules for your loved ones you’ll be sure your family knows how you feel and that you loved them dearly.

Why You Should Create Your Legacy Plan In Your 30s